In the following article, we talk about the main objectives of these talks, their strategies to achieve those objectives, and several significant challenges that stand in their way. 👇

Objectives

Achieving a more resilient, sustainable, and digital tourism industry.

To revive a struggling travel sector

Tourism, one of the sectors most affected by the pandemic, has mainly survived thanks to domestic tourism. Companies have had to make tremendous efforts to maintain activity and jobs in an industry that remains in survival mode today.

Experts expect the real recovery to come when international tourism resumes to previous levels. We need global cooperation and evidence-based measures to lift travel restrictions.

To boost numbers of travelers

One of the consequences of the pandemic has been rising uncertainty and lack of confidence among travelers.

In December 2021, the US Travel Association reported that overseas arrivals into the U.S. were 51% below 2019 levels – 78% compared to October 2021 – following the relaxation of border restrictions.

These numbers are a reflection of similar situations across the world. Traveler numbers remain low, and the industry must look for ways to boost them.

To make travel more sustainable

Although travelers and companies had slowly been adopting sustainable behavior, the pandemic has driven a further significant push for sustainable travel trends.

Travelers are adopting greener options and paying ever closer attention to their impact on local communities and the environment. One aim is to understand these trends better to help make travel more sustainable and therefore more appealing.

To make travel more digital

There has been an acceleration of the digitization of tourism services throughout the entire customer journey: personalized services, better access to information and content, improved entertainment, and streamlined operations throughout the industry.

On the other hand, the user needs to feel more connected and updated at each touchpoint of their journey with less administrative hassle. Think payments, automated processes, contactless services, virtual experiences, and real-time information.

Companies are beginning to accelerate their digitalization. However, there remain significant advances to be made throughout the industry. The use of big data and tourism intelligence is beginning to help organizations access more live information and better understand their environments. We need to place the traveler at the center to understand their needs better and make their experience more satisfying.

Strategy: how to achieve the objectives?

Knowing the customer

Knowing the customer is key to making decisions and achieving our objectives. The reality is that there appears to be a gap between consumers’ expressed interest in sustainable practices and their adoption of them.

The European Travel Commission report on Sustainable Tourism attitudes aims to help European destinations better understand those differences and suggest ways to bridge them/achieve sustainable consumer behavior.

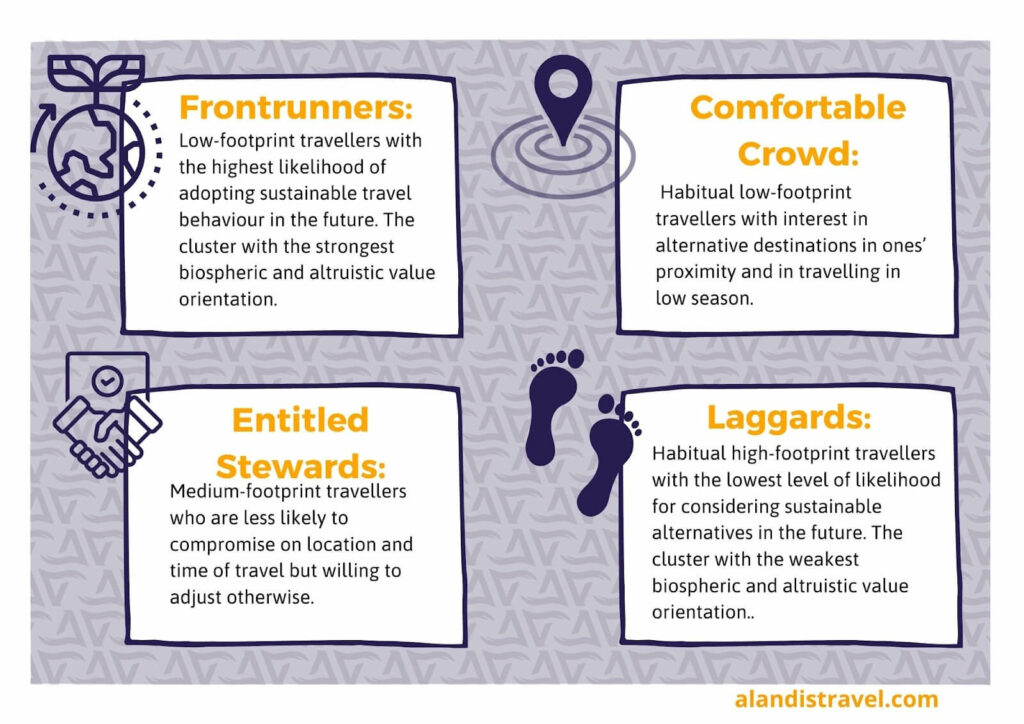

The report identifies four profiles (Frontrunners, Comfortable Crowd, Entitled Stewards, and Laggards). The study suggests strategies for each specific group to stimulate their sustainable consumption behavior and practices.

Skyscanner launched its Greener Choice label, indicating which flights emit 4% less CO2 than the average for a particular route. Consumers have responded positively to this label with growth in choosing Greener Choice flights for their travel.

How has the pandemic changed travelers’ behavior?

Business travel combines with leisure on longer trips

There is a growth in hybrid tourism, where longer stays are combined with work/study at a distance.

A Gobaldat.com study shows that in 2021 more than 52% of global travelers indicated a preference for longer stays. In particular, higher-paid freelancers working from home no longer need a fixed location and only need a quiet place with internet.

This new work model, which looks to continue for some time, could further increase the desire to combine a traditional vacation with a “working vacation.”

An example of this offer is the Day Pass Marriott, which allows for working vacations, includes business counseling, supervised children’s activities, access to semi-private workspaces and meeting rooms, etc.

Less time on reservations. Flexibility in cancellation policies.

Skyscanner conducted a global survey, where consumers said flexible airline tickets with free date/destination changes are essential when booking their next trip.

55% said that canceling the entire booking for free was most important when booking their next trip. Before the pandemic, less than 20% of travelers relied on easy cancellation policies for their bookings.

The flip side of this trend is that free cancellations have financial implications, making these changes challenging to sustain in the long term, and travel suppliers are proposing deferrals instead.

Self-care and wellness experiences

With travel restrictions in 2021 and increased awareness of wellness, the desire to spend more time and money on self-care and stress relief is likely to continue to grow.

A study by the Wellness Tourism Association of 4,000 consumers reveals that 78% include wellness activities when they travel, and 45% of U.S. travelers said they were looking to relax on their next trip.

New expectations on public health and hygiene

While the right price point continues to drive bookings, consumers are now focusing on health and safety. An Amadeus study about the reopening of our industry shows that 47% of travelers worldwide cite a COVID-19-related factor as the most influential criterion when choosing a destination and two-thirds expect to know about COVID-19 prevention measures before booking.

Destinations such as Andalusia (Spain) are offering travel medical insurance policies to stimulate travel demand. All non-international non-resident international travelers can access free COVID-19 insurance until June 3, 2022, at all regulated establishments.

Increased proximity tourism

Restrictions on international travel and government support for encouraging domestic tourism (Singapore’s government with the domestic voucher is an example) have largely sustained travel companies during the pandemic. This trend is likely to continue.

Travelers have taken the plunge to explore within the borders of the countries they call home and have redefined these stays to include work. As international travel returns, domestic travel may slow proportionately. Nonetheless, the trend toward rediscovering domestic destinations is likely to continue long-term.

New tourism hotspots

The desire to travel and search for unknown destinations is the trend that will lead to the emergence of new tourist attractions. Rural spaces and outdoor stays are sought after while having a lower environmental impact and supporting local communities.

Consumer interest in sustainable travel, philanthropy (specifically choosing an experience or vacation to support a destination through tourism), and rural tourism is growing – indicating that new destinations will continue to grow.

Government support

The European Commission has created the first industry ecosystem to work with stakeholders to create the first pathway towards this transition. The report identifies 27 areas for the green and digital transition.

It plans to create an online platform by the end of 2022 so that companies can participate in its process and track their work in this transition. Laying solid foundations now will help define the ETC strategy for 2030.

Four main lines of action have been created:

- Public regulation (to adapt to new developments and requirements): access to public and private data to benefit the sector, cancellation policies, green regulation, smart destination requirements, etc…

- Green and digital transition: more sustainable mobility, reduction of environmental impact and ecological footprint, promotion of sustainable businesses, codes of conduct, tourism data space, etc.

- Resilience: unifying visa procedures, coordinated management of information and border movements, renewal of tourism education, equity and equality in tourism employment, etc.

- Financing: more support for accessing financing through information and support for small and medium-sized enterprises.

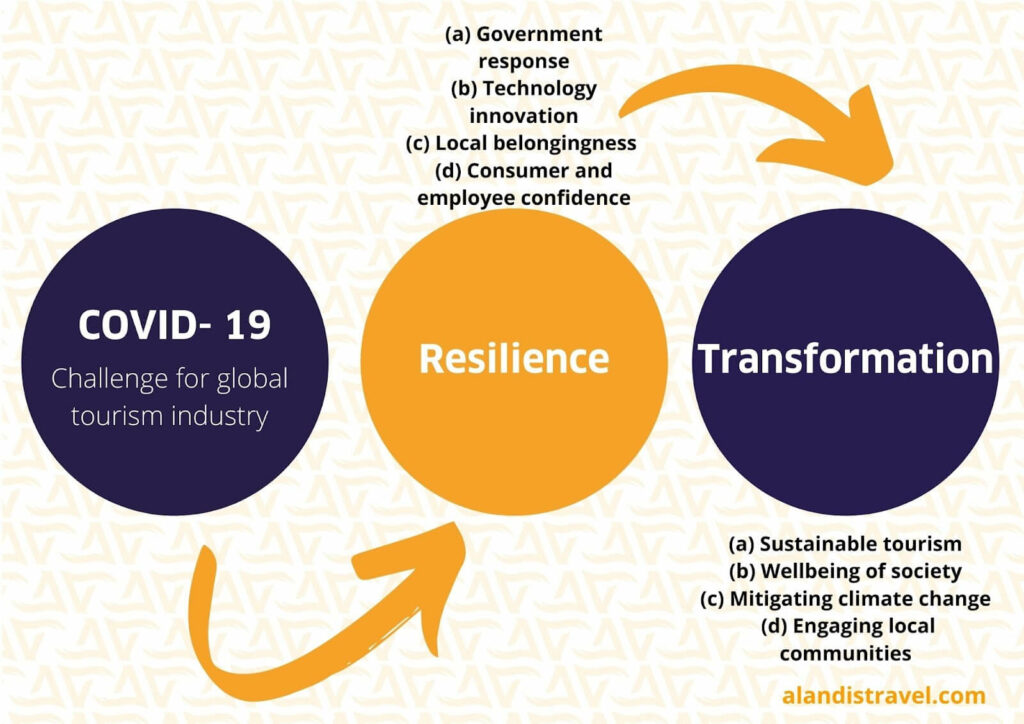

Resilience, In what way?

A recent study by Elsevier.com proposed a post-pandemic resilience-based framework based on the following four factors:

- Government response: various government responses to the COVID crisis have been vital in helping some tourism companies to reduce their costs.

- Technology innovation: mobile apps used to track people’s contacts or big data analytics that predict the spread of COVID-19 among the masses. Privacy concerns are losing importance to gain more technological benefits.

- At the same time, 5G technology and artificial intelligence are spreading, such as biometric data, sensors, and contactless technology. A fast and stable internet connection is essential for guest satisfaction, while technologies in the excursions and activities segment directly improve the actual destination experience.

- Local belongingness: the rise of national tourism has enhanced local ownership. The “tourist bubbles,” or local ties built during the catastrophe, act as a flexible plan.

- Consumer and employee confidence: reducing risk perception and increasing consumer confidence.

The European Green Deal

One of the most obvious ways to boost the travel sector is to recognize climate change and build stronger post-pandemic by aligning with the “European Green Deal” to drive global green and sustainable tourism practices.

Although it has a much broader scope than the travel industry, its objectives align well, and its allotted 600€ million budget will significantly improve travel experiences across Europe.

Fighting for gender equality

Women have felt the economic impact of tourism caused by COVID-19 the fastest and the hardest. UNWTO has developed a series of recommendations for an inclusive response to ensure that women are not left behind.

The next meeting of Europe’s national tourism organizations will take place on 18-20 May in Ljubljana, Slovenia. Hosted by the Slovenian Tourist Board, the event will focus on sustainable tourism practices and gender equality in tourism.

New sustainable, green & digital KPIs

Establishing new sustainable, green & digital KPIs based on the latest research data is key to measuring and quantifying the impact of these initiatives and knowing if the objectives have been achieved. Knowing our progress will lead to making better decisions.

The Trends & Prospects European Tourism Report for Q4 2021 highlights how cross-border travel recovery stalled during the winter following the re-imposition of travel restrictions and lockdown measures across Europe. The report also predicts trends for the resumption of intra-European and long-haul travel.

Challenges

In the aftermath of the pandemic, the E.U. transport and travel committee requested a report on the repercussions of the COVID-19 pandemic on the tourism sector and policy recommendations to address the challenges emerging from the crisis.

Many of these challenges remain, such as regaining traveler confidence and making the green and digital transition.

The pandemic is proving to be a long battle, so understanding the changing context, emerging trends, and consumer expectations is now a principal challenge. It will help businesses, governments and communities adapt and deliver authentic experiences while prioritizing sustainable, inclusive, and resilient growth.

This recovery will never happen without coordination between different stakeholders. Real commitment is necessary – with concrete actions – followed by investment and a subsequent evaluation of the results.

In particular, government support and consensus on actionable steps, legislation, travel laws & guidance will massively boost the sector. Will it be possible?

Long-term thinking and building encompassing all sectors (economic, social, ecological, and cultural) will also require long-term government planning.

Consumer information becomes an important link. The priority of sustainable options remains below more traditional considerations, such as cost and time at destination. This difference in values could be attributed to a lack of information.

Conclusion

We have an opportunity ahead of us – to adapt to these new changes with more information about our consumers, offering a more sustainable and digitized offer.

It seems the most significant challenges are improving and maintaining coordination amongst all stakeholders involved, creating a long-term shared vision, and defining ambitious goals to build the industry of tomorrow.